Making sense of all of your data from all of your projects can feel like trying to understand a foreign language. But, when we break it down into steps, it starts to make a lot more sense.

- News

Integrated Insurance Solutions for Construction Projects

Insurance companies often get a bad rap, but their essential role in safeguarding various aspects of our lives cannot be denied. Whether it’s protecting health, property, or businesses, insurance acts as a safety net, offering financial support when unexpected events occur.

The construction industry is no exception, with a myriad of insurance types required to cover potential risks. From liability and builder’s risk to pollution liability, each policy plays a crucial role in ensuring smooth project operations and mitigating potential setbacks.

Key Insurance: Subcontractor Default Insurance (SDI)

Among the vital insurance options for construction projects, subcontractor default insurance (SDI) stands out. It provides a safety net for general contractors, shielding them from losses stemming from subcontractor defaults. Should a subcontractor fail to meet their obligations, SDI steps in to recoup the general contractor for related costs, ensuring financial protection against potential overruns caused by subcontractor performance issues. Additionally, with the construction industry having such low profit margins, this insurance offers peace of mind to project stakeholders.

Construction Delays and Litigation

Construction projects are no strangers to delays, and these can often lead to legal disputes. Delays, whether excusable due to unforeseen events or inexcusable due to mismanagement, can have far-reaching consequences for both project owners and contractors. Even so, the success of a commercial construction endeavor hinges on adherence to the project schedule. Timely project completion is a critical factor, and any deviation from the schedule can lead to complications in project delivery.

The Role of Project Schedules

Enter the project schedule: a comprehensive blueprint for successful and timely project completion. Unlike other elements of construction, the schedule encapsulates essential information required for project management. However, issues within the schedule, such as poorly sequenced tasks, missing logic ties, or subcontractor mismanagement, can lead to significant delays and decreased construction quality.

Insurance Claims and Schedule Analysis

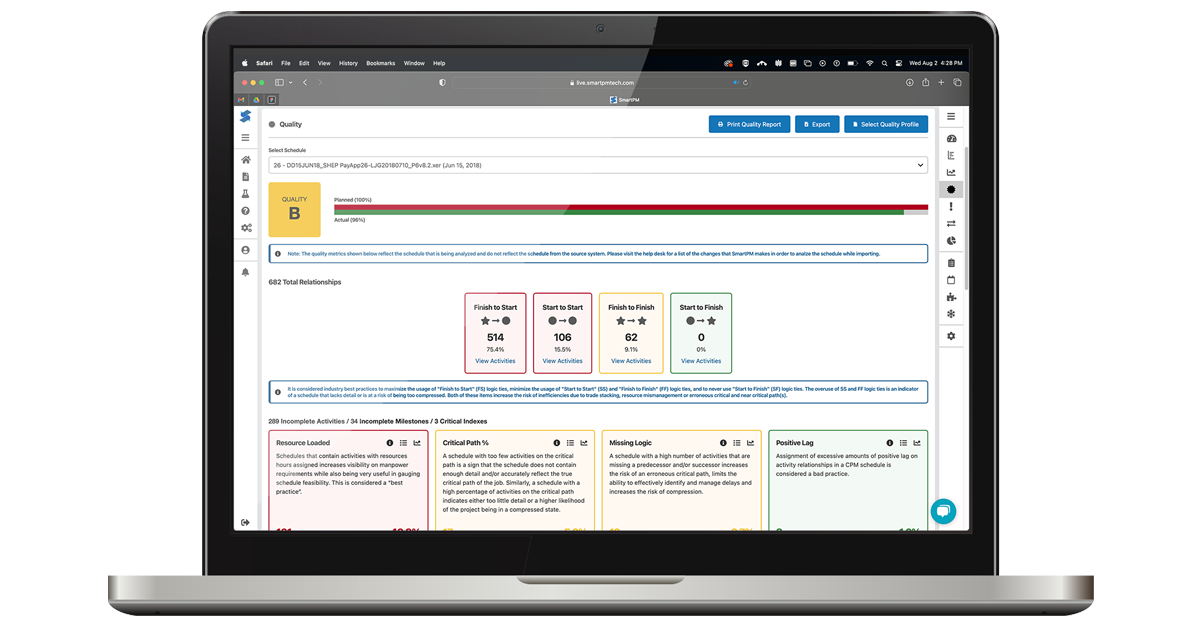

When contractors file claims related to project delays, they must prove that subcontractor activities caused delays that extended the project’s Critical Path, resulting in compensable damages. This often involves scrutinizing the contractor’s project schedule. A robust schedule can make determining fault relatively straightforward. Contractors might leverage data-driven schedule analysis software, like SmartPM, to assess their schedules’ health, both initially and through subsequent updates. In such cases, insurers benefit from accurate information, simplifying claim assessment.

The Need for Insurer-Owned Schedule-Analysis Programs

However, what if the contractor’s schedule is less than ideal, and third-party consultants struggle to pinpoint liability? Insurers need reliable analysis to avoid unwarranted payouts. The solution lies in insurers adopting their own schedule-analysis programs. Relying solely on contractors’ tools isn’t a reliable strategy, and third-party consultants are hit-or-miss. Insurers equipping themselves with tools like SmartPM ensure accurate liability assignment for delays, potentially saving considerable claim settlement costs and investigation time.

Preventing Delays with SmartPM

SmartPM isn’t just about post-event analysis; it can be a powerful preventive tool. Insurers can assess initial project schedules using SmartPM’s Quality Checker, assigning an overall quality grade. A robust schedule reduces the risk of future litigation while identifying flaws early allows for timely revisions, preventing potential delays.

A Win-Win Solution

As an insurer, your clients rely on you to compensate legitimate claims. Yet, substantiated claims are essential. SmartPM offers a win-win solution. It saves insurers money by ensuring accurate claim assessments and reduces investigation time. Furthermore, it empowers contractors to create stronger schedules from the project’s outset, setting the stage for successful project execution.

Insurance’s role in construction projects goes beyond financial protection; it’s a mechanism for ensuring smooth operations, mitigating risks, and resolving disputes. By embracing technology like SmartPM and fostering a collaborative approach, insurers can enhance their service quality, streamline claim processes, and contribute to the overall success of construction projects. If you’d like to see how SmartPM helps insurance and contractors alike, fill out the form below, and I’d be happy to show you how.

RELATED STORIES

Making Construction Data Analytics Easier to Understand

Making sense of all of your data from all of your projects can feel like trying to understand a foreign language. But, when we break it down into steps, it starts to make a lot more sense.

Overcoming Confirmation Bias in Construction Project Management

Confirmation bias can be particularly problematic in project and schedule management, where decisions must be based on accurate and comprehensive information.

Top Construction Scheduling Software in 2023

SmartPM’s recognition as a top construction scheduling software in 2023 attests to the immense value in automated project controls.

Putting the ‘Smart’ in Project Management with Project Controls

Project controls are not just a subset of project management; they are its backbone, focusing on meticulous monitoring and analysis.